Why - Trading Questions Answered

In trading we all tend to ask nearly every day:

- Why did the price stop?

- Why can't we predict the price?

- Why is this the top or bottom?

- Why does the price break this level?

- Why are others placing fake orders?

And of course numerous other "Why" questions.

The why question is so powerful and omnipotent that it can sometimes torture us. Then we look for answers and solutions by force to find answer to "WHY".

To cut a long story short: There are no always satisfactory answers to the "Why" in trading. We can only approach answers to a certain point.

Why isn't a Classical Chart helpful?

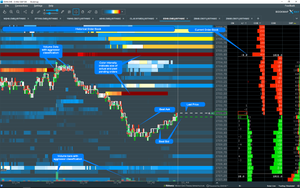

What can you say about this chart?

- It is a clear trend up

- Trend line is up

Now you may say: "There is a trend" and "This trend will continue". But in fact it only means: "There have been a trend until this moment." It should be clear, there is no evidence that this trend must continue or that this trend must reverse. At this moment we simply don't know. We assume and we hope.

Why does this trend stop here? Why did it reverse? Why did it continue?

I believe that this questions can't be answered based on classical charts. Why not? Because we don't see what is happening and don't have any indication what is "behind the curtain". We are the "audience" and we see what we should see.

All classical charts based on Technical Analysis (TA) mislead us, because they use history data to plot patterns. They rarely consider that these patterns appear in a random, by definition unpredictable environment.

Informed vs. Uniformed Trader

I refer to the informed traders as the investors who have a temporary informational advantage over other market participants. They obtain this informational advantage, because they either have some private information or they are able to correctly process new public information more quickly than other investors in the market. [1]

The informed investors usually use their temporary advantage to trade with the uninformed investors and extract profit from these transactions.[2]

The second main assumption is that the informed investors act on their information by submitting buy or sell orders. Thus, the informed investors partially disclose their information through their trades that cause higher permanent price changes, compared to the trades of the uninformed investors. [3]

When a large number of informed traders enters the market for a stock, this signals a higher probability of a price change in the near future after information has been released to the market. However, the uninformed traders do not know ex ante the direction of the price change that depends on whether the news released will be positive or negative. [4]"Informed" traders are traders who posses more informations about a company, stock or event. “Uninformed” traders are risk averse and traders who represent liquidity providers.

Why can't we predict the price?

As you know an Order Book consists of a "Limit Part" and a "Market Part". The limit part represents all Limit Orders which are placed by informed and uninformed traders. The market part represents all orders which hit the market by both groups at a random time.

Why can't we predict where the price is going next? Because we can't forseen when and how aggressively market participants are hitting the order book at the market price. The arrival of aggressive orders is hardly predictable.

But there is chance, though!

Why analyzing passive orders?

If the arrival of aggressive orders is hardly predictable, we must make this prediction based on observation of passive orders:

- Are they weakening from the pressure by aggressive orders?

- Do they desert, cancel or move orders away?

- Do they stand the ground and absorb the pressure?

- Do they bring even more forces?

Observing market depth and answering these questions helps predicting the outcome.

Why is the price bouncing off? Because informed traders are bringing more liquidity to the price level.

Why is the price falling through price levels? Because informed traders are cancelling their limit orders.

Why is this level holding? Because informed traders are standing the ground and absorbing all incoming market orders.

Why Liquidity is important?

We can always detect liquidity concentration above and below the current price.

On Bookmap™ X-Ray liquidity concentration can be seen in advance. If the price reaches this levels:

- Price goes through, because passive limit orders retreat making the liquidity mark at this level irrelevant

- Aggressive orders retreat and fail pushing the price through the liquidity - price bounces back

- Fight between aggressive and passive orders, leading to large traded volume

Liquidity is the "blood" of the market and its observance in daily trading turns an uninformed trader into an informed trader!

See also Liquidity 1 - Liquidity 3 in the Post section of my website.

Why are traders placing fake / spoof orders?

First of all I wouldn't speak of such thing as a "fake" bid or offer. It is a "No Intention" to buy bid or to sell offer orders though. Basically, the reason large traders (and some smaller traders in thin securities) do this is to give the impression that there is either an abnormally large buyer or an abnormally large seller in the market.

Consider following:

If you have a large amount of stocks e.g. 100.000 or future contracts e.g. 1000 to sell, then you can't do it all at once because you would manipulate the price to your disadvantage.

Likewise if you display the order to sell on level 2, people may see that there is a (legitimate) large seller in the market and sell, driving the price down and preventing you from selling where you want as well as lowering the value of your investment.

Another option could be to sell 1000 future contracts but hide it on level 2 as not to scare people. Otherwise you could place 200 contracts to signalize to smaller traders that there is enough liquidity that they can buy 50, 100 or more contracts if they want, but not so much that there is a need to have 1000 and more buyers behind them to make the price go up.

The problem with all of this is that you want to sell lot of contracts / shares into a market that doesn't have a lot of buyers.

You need demand. To create demand you might display/spoof/fake a buy order with NO INTENTION to buy of, let's say 500 contracts on the bid. Now it seems that there is a large buyer in this market. This will create demand and entice retail/uninformed traders to buy. They wil buying from you as your hidden order fills piece by piece.

This is a risky game for the seller, though. As mentioned above there are no such things like "fake orders". This 500 buy order is real at that moment! If there is a big seller right at that moment when the intentional seller is trying to find buyers for his inventory and if he doesn't cancel his orders fast enough he will get a fill and will be long 500 contracts more.

That's the real risk of placing "non intentional" orders. Beside it is illegal under the 2010 Dodd-Franck Act.

Everything can be inverted to spoof on the sell side and create artificial sell pressure if there is a need to buy before the price goes up. Both of these things are, despite being illegal, practiced pretty regularly by manipulative hedge funds and large traders.

HFTs do this too but very, very fast so you often won't catch it on level 2 unless you are working with a level 2 visualization software like Bookmap is. Algos can use it as a method of price discovery also.

Are there other questions to consider? If so, place them in the comment below.

[1]-[4] Informed Trading and Market Efficiency by Olga Lebedeva, 2012

Comments